stratupnation.blogspot.com

TechCrunch announced in early April that TechCrunch Disrupt, one of the biggest events in the startup world, will be making a comeback this year. Both the conference and Startup Battlefield will be back in person on October 21 after being forced to go virtual due to health concerns around Covid19.

Ever since launching in 2011, the annual conference has become one of the main scenarios for startups looking to introduce game-changing technologies, products, and services. With the startups being the center of attention each year, the event presents a unique opportunity to attract investors, top talent, and partners.

Getting a startup off the ground is no easy feat, which is why the event has become a favorite for founders looking for that initial boost. By participating in the competition, after parties, different alleys, and the hackathon, the opportunities are multiple. Geniuses like Zuckerberg, Benioff, Musk, Kalanick, Mayer and Dorsey have all participated in TechCrunch Disrupt in the past, making it a stage for the rising stars of the tech world.

If you are part of a team looking to have its startup noticed by those with the power to ensure its success, this is an event you should partake in. After all, as HBO’s Silicon Valley showed, this is the place for those looking to make the world a better place.

The Struggles of Getting a Startup Off the Ground

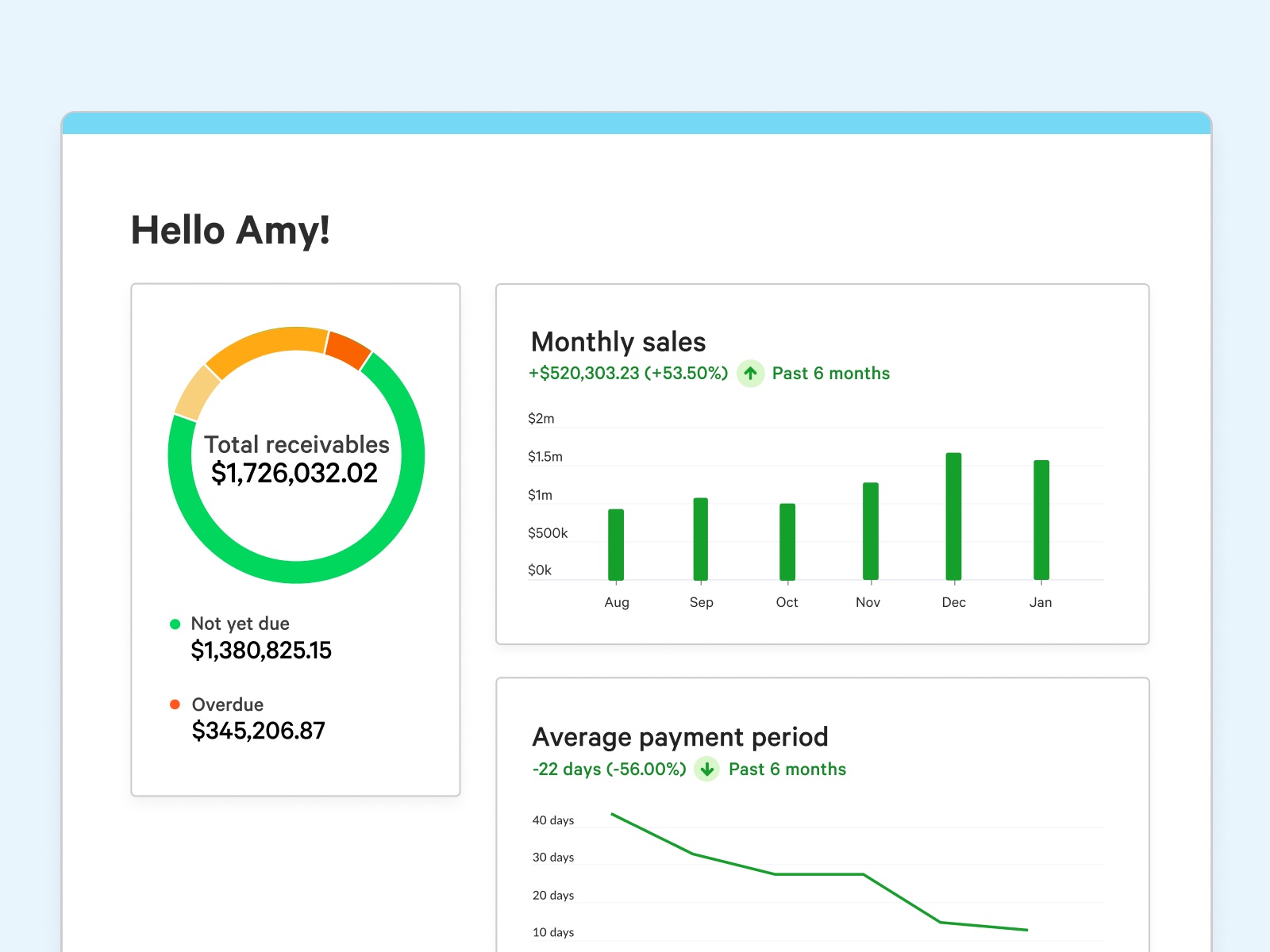

According to Crunchbase, over 23k startups raised seed funding between 2016 and 2022, quite more than the almost 18k startups that raised seed funding between 2011 and 2015. In addition to this, data also shows that the valuation of seed rounds has also grown to become comparable to the Series A back in 2016.

While you could imagine that getting your startup to succeed would now be easier than ever, this is not the case. As any entrepreneur or founder knows, it is a battlefield out there when it comes to getting funding. With about 305 million startups being founded each year according to Forbes, competition is at an all-time high. This competition is one of the main reasons behind a well-known statistic: 90% of all startups fail between the first 10 years.

Most serial entrepreneurs will agree that there is no “fail-proof” strategy to have a startup succeed… They are right. However, most agree that the early stages of a startup are the most important as, after all, startups are all about disrupting their respective industries. Doing it with a bang will always play in your favor.

While there are cases in which successful founders choose to found a new startup, founders will not have founded a previous startup more often than not. This means that most founders have no previous experience in navigating the turbulent waters of entrepreneurship, which puts them at a disadvantage.

If this is your case, worry not. Fortunately, startups have proven to be a sound investment most of the time, with 2021 setting a new record for the amount of money invested by venture capitalists at a whopping $621 Billion. This has created an incentive for Startup incubators to spread around the world, helping inexperienced founders like you launch your startup.

Incubators will usually focus on helping you prepare your startup to attract investors and raise funding through funding rounds. However, there are many other ways in which startup founders can raise the money to help them survive the early stage, with one of these being startup competitions.

TechCrunch Disrupt is home to one of the biggest startup competitions in the world: Startup Battlefield. As of April of this year, this competition has seen over 922 companies participate for over $9 billion, resulting in 121 exits. If you think your startup has got what it needs to win against another 199 startups, let us tell you everything you need to know about the competition.

What is TechCrunch Startup Battlefield?

As the name suggests Startup Battlefield is an event that brings startups to compete with each other. Unlike other competitions, this event will see early-stage startups instead of already established ones, providing the winners with equity-free prize money.

With names like Yammer, Dropbox, Mobalytics, Vurb, Qwiki, and Mint, having won the competition in the past, Startup Battlefield has made a name for itself. If your startup chooses to participate, you can be sure that top media outlets and investors will be keeping a close eye on your performance.

So far, Startup Battlefield has taken place in Sub-Saharan Africa, the Middle East & North Africa, Australia, New Zealand, and Latin America. This year, the Global competition will take place during TechCrunch Disrupt in San Francisco on October 18th-20th. However, regional competitions also take place from time to time, so you should keep a close eye on those.

Startups that wish to participate can do so as the event is not only open but also entirely free. This means that with a prize of $100.000 on the line and all attention on it, you got nothing to lose and everything to gain from participating.

The big prize is not the only reason to participate in Startup Battlefield. In fact, the competition will provide participants with much more benefits starting this year. Trust us: being selected to participate in this year’s event is enough prize in itself. Let’s talk about that.

How Does Startup Battlefield Work?

TechCrunch’s Startup Battlefield will be changing this year. After all, this is the first edition of the competition after being 2 years on hold because of the pandemic. This year’s competition will showcase the 200 startups that TechCrunch considers to be on the top of the global startup ecosystem.

The 200 startups that participate in this edition will be receiving training, access to private receptions and communities, and participate in several meet and greets with investors. Founders like you will also be able to flash-pitch in front of a panel of judges composed of TechCrunch Editors and investors. Lastly, all of the 200 startups will have free exhibition space during TechCrunch Disrupt, independent of the selection process we will mention in a moment.

Depending on the panel’s decision, the top 20 startups will be selected to be finalists and partake in an “intensive mini-accelerator” 8 weeks prior to the event. During this program, the startups will receive even further support to improve their business model and pitches.

Once the time comes for their pitch in TechCrunch Disrupt, each startup will have 6 minutes to pitch in front of the judges. They will also have to engage in a question and answer session with experts from different industries, including names like Marissa Mayer, Ron Conway, Fred Wilson, and Roelof Botha. This will take place on Disrupt’s main stage, which means the entire TechCrunch audience will be paying close attention.

If your startup is the winner after all of this process, it will be the winner of a $100.000 prize free of equity. However, the publicity, experience, and support the event will provide is sure to be more valuable than the cash… We are not saying that the cash doesn’t help, though.

What Are the Requirements to Participate?

The first thing you want to do before learning about the application process is to make sure your startup is eligible to participate in Startup Battlefields. These are pretty easy to fulfill and are the following:

- Be an early-stage startup.

- Have a minimally viable product.

- Represent any vertical.

- Represent any geography.

- Have step-function innovation in your vertical.

- Be bootstrapped or have pre-scale funding (variable by industry).

If your startup is eligible to participate, it is just a matter of applying. As applications are accepted on a rolling basis, it is important not to procrastinate. By sending your application early, you will get more chances to be accepted!

What Is the Application Process Like?

If you have founded a startup already, applying to TechCrunch Startup should be pretty easy but quite extensive… depending on how prepared you are. The process is as easy as filling out a form providing general information and preferences. The general information required includes:

- Startup name

- Startup website URL

- PitchBook or Crunchbase URL

- Name, last name, phone number, email, and title of the point of contact

- Startup incorporation and office location

- Number of employees

This is information you surely already possess and can provide fairly easily. However, remember that TechCrunch is looking to have top startups participate in Startup Battlefield. As such, a pitch of sorts will be necessary.

The next part of the application form is focused on letting the organizers know what your team and startup are all about. Some of the questions in this section have probably already come to your mind and you might have an answer for them, some might look new to you. While there is an application deadline and a limited number of slots, you should take your time answering all of the following questions:

- Why is your team uniquely suited to build this company?

- In one sentence, what are you building?

- What core problem do you solve?

- What is the primary use case for your product?

- What is your solution?

- Who wants your product or service?

- If launched, what is the current feedback and testimonial on the product? What is the NPS? Churn?

- How big is your initial target market? Your total addressable market? TAM, SAM, SOM?

- How do you/will you make money? Business model.

- How do users find out about you? How do you distribute your product?

- Summarize your traction.

- What is your customer acquisition cost?

- Do you have any revenue?

- Who are your biggest competitors?

- Why will you win amongst your competition? What makes you unique?

- Is your product proprietary?

- Do you plan to raise capital? If so, what are the milestones you are planning to achieve?

- Will you be launching something new onstage?

- If so, what will you be launching on stage?

Now, you will need to provide 2 videos. The first video should be a product demo in the form of a short 2-minute video. Remember that the product has to be functioning. The second video should show the founder(s) explaining the product in less than a minute. These 2 videos are all about the content, not the video production!

In order to ensure there are no conflicts of interest, TechCrunch will also require you to provide financing and investment-related information. This includes:

- Total money raised

- Date of the most recent funding

- A list of your investors, advisors, and any incubator/accelerator program you have participated in.

The Press/Outreach section will allow the organizers to get an idea of how well-known your startup is and how you learned about the competition. While you would think that the more exposure your startup has, the opposite is true: Startup Battlefield looks for startups that have flown under the radar for the most part. This section will require you to provide the following information:

- Press coverage summary

- How did you hear about the competition

- Who referred you?

Finally, you will be asked for some additional information which quite frankly, could have been asked in the previous sections. The information required in this section is:

- Startup’s date of incorporation

- Startup categories and industries

- Number of founders

- Founder information

- First and last name

- Title

- Linkedin profile

- AngelList profile

- Founder’s specialty

- Demographic information

- Gender

- Are they a veteran?

- Do they identify as LGBTQ+?

- Ethnic background?

- Do they identify as a person with a disability?

- Age range

Once all of this information has been provided, you will be able to submit the application to Startup Battlefield and have a chance to join the other 199 startups.

An important thing to keep in mind is that while the application deadline is July 31st, acceptances will start rolling out on July 1st.

Conclusion

As you can see, applying to participate in Startup Battlefield is an easy process that will provide you with important insights from the get-go. By filling out the application form, you will already be identifying key aspects that will come useful for future pitches, even if you are not selected.

If TechCrunch finds your application to be good enough to be considered one of the top 200 applicants, the benefits will be even bigger. By participating in Startup Battlefield, TechCrunch will provide you with exposure, networking, and marketing platform, training, and if you win, money to help your startup grow. All of these without having to invest any money, commit to giving equity in return, or any of the other headaches that we all have grown used to.

If you are looking for an extra boost to get your new startup off the ground, this is it. Don’t miss the chance to compete with other teams out there and enter the world of startups with a bang!

Adblock test (Why?)

"Startup" - Google News

April 29, 2022 at 03:27PM

https://ift.tt/Wu8X1aG

Everything You Need to Know about TechCrunch Startup Battlefield this Year - Grit Daily

"Startup" - Google News

https://ift.tt/60fxOhG

https://ift.tt/UCZkTIv

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23421125/Screen_Shot_2022_04_27_at_4.50.14_PM.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23421126/Screen_Shot_2022_04_27_at_4.49.56_PM.png)