It appears battery startup SES’ investors are quite happy with its first earnings report. The company went public in February via a SPAC merger, and to no one’s surprise, reported a loss.

And its investors don’t seem to mind. Its shares, while still trading below its SPAC merger price, were up 16.7% at $6.15 at the time of writing, outpacing broader markets gains earlier in the day.

The company posted an operating loss of $19.2 million in the first quarter quarter. General and administrative costs accounted for much of that, at $15.1 million, while R&D ate up another $4.1 million. It reported a net loss of $27 million, or $0.12 per share.

At the end of the quarter, SES had $426 million in cash and expects to have enough runway to enter commercial production in 2025.

Battery startups like SES all lose money, and it looks like the company is losing just enough to stay in the race, but not so much that it would burn through its reserves before it has a commercial product. Developing and commercializing a new battery is a long, expensive game and investors seem to be happy with SES’ balancing act. If it spent too much, it would risk bankruptcy, of course. And if it didn’t spend enough, it would risk falling behind its competitors.

Investors also appear to be rewarding other battery startups that have gone public via SPAC in the last year, including Solid Power, which is up 10%, and QuantumScape, which is up 13%.

The balance of general expenses versus R&D suggests that while work continues on its lithium-metal technology, an increasing amount of the company’s cash hoard is being spent on building larger scale facilities in the ramp up to commercial production.

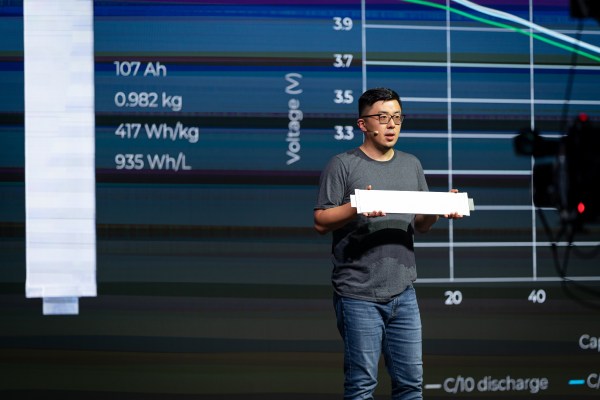

Indeed, in an interview earlier this week, CEO Qichao Hu told TechCrunch the company is continuing to develop its Shanghai Giga site and another facility in Korea, which was announced earlier this year. Currently, the Shanghai site has an annual production capacity of 0.2 GWh, which Hu said is “more than enough” for what they are making right now.

“In March, we started building cells for Hyundai and Honda out of our Shanghai facility, and for GM out of Korea facility,” he said.

The company is testing these cells in-house and then sharing the data with partners. By first quarter next year, Hu expects to begin shipping cells directly to automotive companies so they can do their own testing.

"Startup" - Google News

May 14, 2022 at 12:58AM

https://ift.tt/vAs459C

Investors reward battery startup SES for losing money (but not too much) - TechCrunch

"Startup" - Google News

https://ift.tt/BHroy7S

https://ift.tt/OxJhMF5

No comments:

Post a Comment