Mobile banking startup Varo is becoming its own bank. The company announced on Friday it has been granted a national bank charter from the Office of the Comptroller of the Currency (OCC) and secured regulatory approvals from the FDIC and Federal Reserve to open Varo Bank, N.A. The news follows Varo’s recent close on an additional $241 million in Series D funding aimed at helped Varo transition its service to its own bank, as well as expand into new banking products and hire new staff across operations, marketing, risk, engineering, and communications.

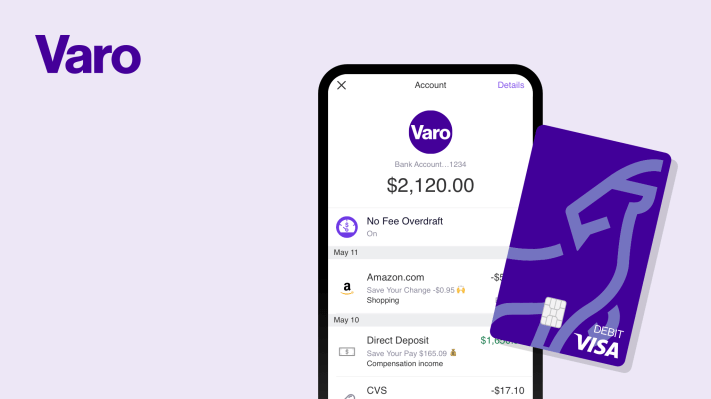

Launched in 2017, Varo offers banking services aimed at younger consumers comfortable with doing all their banking online, without access to physical branches. The company competes with a range of mobile banking startups, including Chime, Current, Space, Cleo, N26, Empower Finance, Level, Step, Moven and many others.

Like most of its rivals, Varo offers an easily accessible bank account with no monthly fees or minimum balance, plus high-interest savings, and a modern mobile app experience. Despite its lack of brick-and-mortar branches, Varo customers can access their money through a network of more than 55,000 fee-free Allpoint ATMs worldwide.

Currently, Varo provides the front-end to customers’ banking services, but the actual accounts are held by The Bancorp Bank. These accounts will transition to Varo Bank over time.

Varo notes it’s the first U.S. consumer fintech to be granted a banking charter. But others may soon follow. In March, Square said it received approval from the FDIC to conduct deposit insurance so it could open its own bank, Square Financial Services Inc. SoFi in July also filed an application with regulators to create SoFit Bank, in order to expand into new products.

That’s Varo’s plan, as well. The company says the banking charter will allow it to serve a broader set of customer needs, including “financial resiliency, affordable access to credit, and the easier management of volatile cash flows.” Or, more simply put, credit cards, loans and savings products.

These expanded offerings will be useful to customers amid the economic downturn drive by COVID-19 health. Already, Varo responded to the pandemic by offering early access to stimulus deposits, increasing deposit and ATM limits, and expanding tis partnerships with job platforms to help customers find work.

“This is a thrilling milestone for Varo, as the bank charter has been a core part of Varo’s disruptive vision from the very beginning,” said Varo Bank founder and CEO Colin Walsh, in statement. “2020 has been challenging for many of us across the country and has highlighted, once again, how the traditional financial system is not meeting the needs of hardworking, everyday Americans. The ability to operate as a full-service national bank gives Varo more freedom to deliver the kind of innovation and allyship that many Americans have never had from their bank before. We are excited to lead a new wave of financial inclusion by offering fair, transparent, intelligent, and comprehensive financial services to all,” he added.

"Startup" - Google News

August 03, 2020 at 09:51PM

https://ift.tt/30sV0dX

Mobile banking startup Varo is becoming a real bank - TechCrunch

"Startup" - Google News

https://ift.tt/2MXTQ2S

https://ift.tt/2z7gkKJ

No comments:

Post a Comment