The evolution of job growth and employment in the U.S. economy over the past four decades has been characterized by two important but seemingly contradictory facts: Young startup businesses have been a key driver of economic growth, yet more and more of the American workforce has become concentrated at older, more mature firms.

This window into the nation’s economic trends comes from the U.S. Census Bureau’s Business Dynamics Statistics, or BDS, which provide annual measures of establishment openings and closings, firm startups and shutdowns, and job creation and loss.

The BDS paints a portrait of the constantly evolving and dynamic U.S. economy over time and provides information on the contributions to employment changes across and within industries.

These measures are available for the entire economy and by industry (sector and 3-digit and 4-digit North American Industry Classification System or NAICS) and geography (state, county and metropolitan and micropolitan statistical areas).

They’re also published by firm and establishment size and age. Statistics are available from 1978 to 2019.

In this story, we summarize recent findings using the publicly available statistics to describe the dynamics of the U.S. economy over the past 40 years. We specifically focus on the role firms of different ages and sizes played in the creation of jobs across various industries.

Age and size of firms

As prior research has shown, the age and size of a business are important characteristics that may reflect its potential to create jobs and economic growth.

The BDS allows us to distinguish between the age and size of an establishment (a physical place of work) and the age and size of the firm (the larger enterprise that owns and operates the establishment).

Firm age is defined as the age of the oldest establishment in the first year in which a firm has employees. We define a startup as any firm that employed its first worker in the current year.

New establishments created by new firms will have job creation patterns that resemble other startups. But new establishments created by long-existing firms will grow in ways that reflect the trends of mature firms.

In addition, an establishment that belongs to a larger parent company may act differently than an independent establishment.

For the purposes of this article, we focus on two age categories: young and old. Young firms are those with positive employment for five years or less, and old firms are those with positive employment for more than five years.

A firm’s size is based on the first quarter employment of a given year and includes all establishments associated with the firm at that time. We consider firms with 100 or more employees “large,” and those with fewer than 100 employees “small.”

Increasing share of employment in older firms

One of the major trends over the past three decades is that employment has become increasingly concentrated at older firms.

After falling in the 1980s, the share of employment at more mature firms rose steadily, representing approximately 90% of all employees by 2019 (Figure 1).

The patterns in a few notable industries mirror this national trend. By the mid-2000s, for example, the Manufacturing, Retail, and Health Care sectors all had over 90% of their employment at mature firms.

There were exceptions: Accommodation and Food Services and Information sectors.

Restaurants and hotels had a lower share of employment in older firms relative to other industries over the entire time series. This share dipped even lower in the late 1990s, then rose until the early 2010’s, and has been flat or slightly declining since.

The Information sector trended somewhat away from older firms through the tech crash in the early 2000’s but has risen since and is now nearly 95% concentrated in mature firms.

The large and increasing presence of employment at old firms appears to contradict the notion that young startups are the engine of economic growth. However, it is true that young firms are more dynamic and have much greater rates of net job creation.

The Net Job Creation Rate, or NJCR, indicates how many more jobs were created than were destroyed relative to overall employment in an industry.

The job creation rate is notably higher for young firms than for old ones — the NJCR has hovered around 15% to 20% for younger firms throughout the time series but was roughly 0% and often negative for more established firms.

The NJCR time series is more volatile for young firms than old ones, showing larger drops during business contractions and larger gains in expansions (Retail and Manufacturing during and after the Great Recession, for example). Despite these fluctuations, the rate is almost always higher for young firms.

The single exception is the Information sector in 2001, when the job creation rate for young firms fell to the same level as for old firms.

Therefore, it is simultaneously true that startups grow at faster rates but old firms account for an increasing share of employment.

Reconciling these facts requires noting that there are fewer startups over time and in turn fewer young firms over time (Figure 3). That is, the net growth rate differential between young and old has not changed much but there are fewer and fewer young firms over time.

Employment concentrated in larger firms

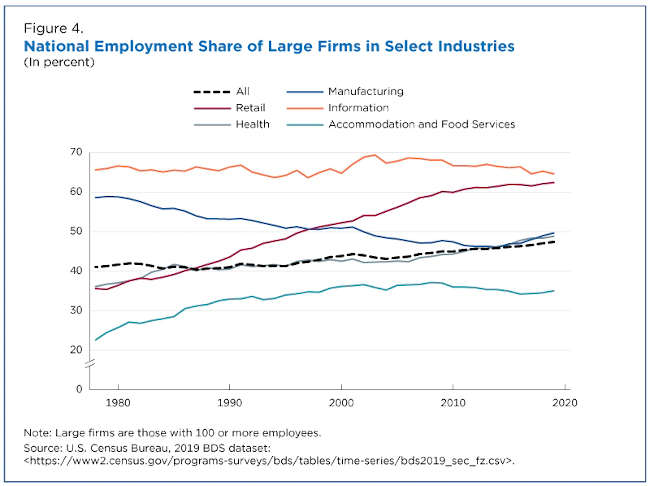

Mirroring the growing share of employment at older firms, the share of employment located at large firms with at least 100 employees also increased.

The national share of employment at these large firms has grown from 41% at the beginning of the time series in 1978 to 48% at the end of the series in 2019.

However, this steady rise in the national share masks considerable industry variation.

Manufacturing has notably defied this trend, becoming more concentrated in smaller firms, despite a slight reversal of this pattern in the last few years.

The Information and Accommodation and Food Services sectors have also moved away from larger firms since the mid-2000’s, despite moving towards them during other time periods.

Retail ‘Megafirms’

The increasing concentration of employment at large firms is most obvious in the Retail sector, which grew steadily from a 36% share in 1978 to 62% in 2019.

Retail’s status as an industry dominated by large players is well-known, with the familiar rise of so-called “megafirms” that have crowded out smaller firms during the last two decades.

Recent research using Census data suggests that the increasing presence of such firms helps explain the decline in the share of national income going to labor, as these firms tend to be capital intensive and highly efficient.

Does age or size influence job creation more?

The increased concentration of large firms in the economy appears to have a smaller impact on job creation than does the increase in older firms. This is because small firms have higher rates of job growth than large ones but not by nearly the same margin as between young and old firms.

During economic expansions, the net job creation rate of small firms exceeds that of large firms by a few percentage points. However, during contractions, the rates fall to nearly the same negative level as large firms.

This is especially apparent in the Information sector during the 2001 recession, where small firms destroyed jobs at a higher rate than large ones.

The NJCR in this sector remains lower today than in the 1990s but aside from the Great Recession, small firms have created more jobs on net than large ones since the mid-2000’s. The exception to this trend of stagnant job growth at large firms is Retail, where large firms have mostly out-performed small firms in net jobs created.

BDS data tables are available for further analysis. BDS data can also be accessed via the BDS Explorer application and guidance on how to use it is available in this webinar.

Christopher Goetz is an economist in the Center for Economic Studies, or CES, at the U.S. Census Bureau. Martha Stinson is a senior economist in CES.

"Startup" - Google News

February 21, 2022 at 04:35PM

https://ift.tt/ZjlcID2

U.S. startups create jobs at higher rates, older large firms employ most workers - Lake County News

"Startup" - Google News

https://ift.tt/LNfk6aE

https://ift.tt/HhkuDyJ

No comments:

Post a Comment