Hello, it’s Ian here in San Francisco. One of the central, lingering questions of the chip shortage is how bad it really is, but first…

Today’s top tech stories:

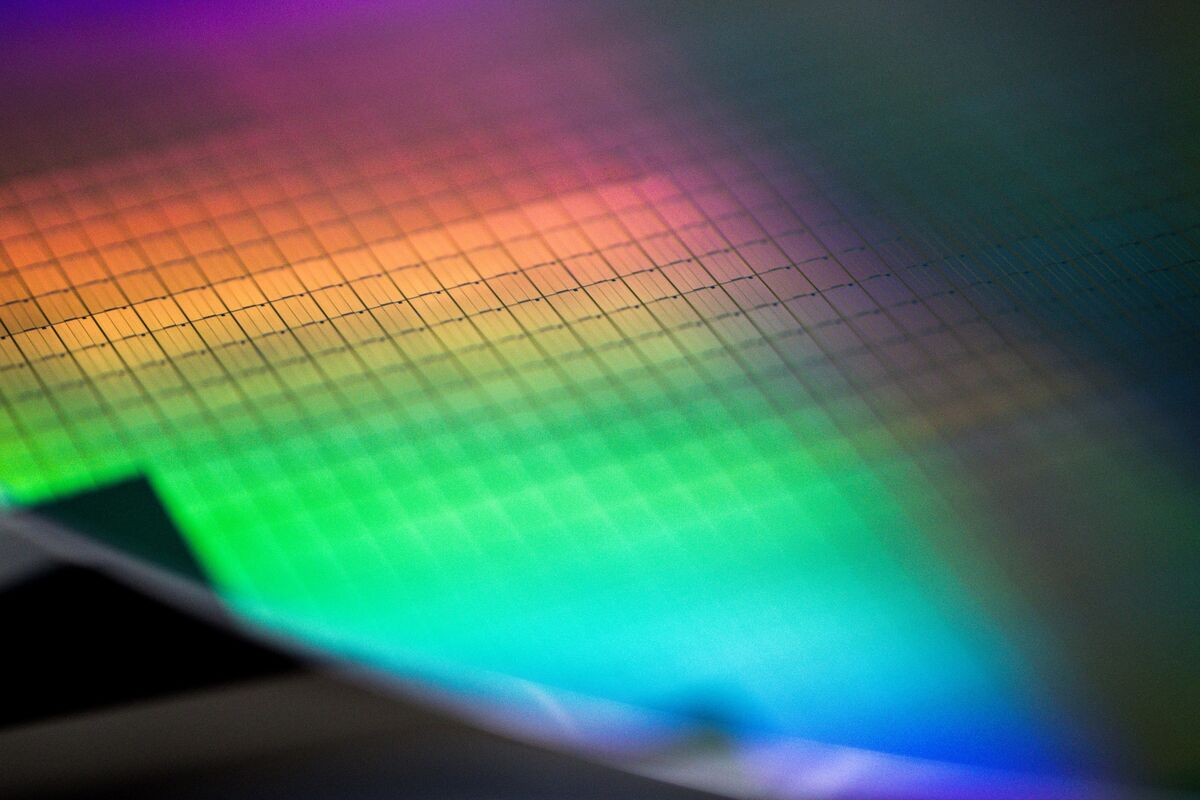

The chip mystery

Last week the White House set out to solve a central mystery in the chip shortage that has dogged the global economy for months: Just how bad is it really?

The Biden administration is considering invoking a Cold War-era national security law to force companies to provide details of inventory and sales, Commerce Secretary Gina Raimondo said Thursday. The threat came in response to previous meetings that have left the government frustrated at the lack of information provided by an industry that’s asking for federal help to pay for new capacity to alleviate shortages.

The move could force the companies to disclose closely held details of who’s getting the best deals and who’s hoarding stockpiles as a competitive advantage. Chip executives won’t like it, but investors might.

It’s not just the government that’s trying to get a handle on what the shortage means for the financial health of chip companies. Investors have been concerned that the industry's massive run-up in revenue and earnings has been spurred by panic buying, and that soon, the resulting accumulation of unused inventory will cause a crash. Chip industry executives have argued that this time is different, there’s been little inventory buildup and demand for everything from phones to cars is strong enough to swallow any increases in production.

The picture is so murky partly because many deals for chips involve long-term confidential contracts. Chipmakers, particularly in times when demand is outrunning supply, put their customers on what they call allocation, their system for deciding who gets what. That makes it even more imperative for companies to keep private which customers are getting preferential treatment.

The uncertainty around the shortage has bedeviled chip customers, who see no end in sight. “It clearly is frustrating,” Cisco Systems Inc. Chief Executive Officer Chuck Robbins told me last week. “It’s most frustrating because we’re not able to deliver things in a timely fashion to our customers.”

Like many of his peers, Robbins is predicting shortages will persist into the first half of 2022.

On the flip side, haziness about chip deals isn’t bad for everyone. Some companies, such as Dell Technologies Inc., have boasted about the ability of their supply chain managers to obtain more needed chips than their rivals, boosting results. Those customers will be reluctant to publicize details of how they've done that. Negotiation over chip deals could get awkward quickly if, say, Hewlett Packard Enterprise Co. learned it’s paying more for the same server chips as Amazon.com Inc.

In the meantime, one U.S. company is touting its moves to boost chip supply in the U.S. On Friday, Intel Corp. held a ground-breaking ceremony for two new plants in Chandler, Arizona. The cost of the facilities will total about $20 billion, and crucially they won't be fully operational until 2024. That’s way too late to help with the current crunch. It’s yet another reminder for the chip industry—and those of us who rely on it—of the gargantuan time and cost of re-balancing supply and demand. — Ian King

If you read one thing

Bloomberg Businessweek’s latest cover story goes inside the quest for a better battery, a central problem for efforts to combat climate change.

Here’s what you need to know

YouTube’s CEO says the platform is “valuable” for teens’ mental health.

TikTok says it has 1 billion monthly active users.

Here are 10 companies to watch this quarter.

"bad" - Google News

September 28, 2021 at 05:45PM

https://ift.tt/2XRttDW

No really: How Bad Is the Chip Shortage? - Bloomberg

"bad" - Google News

https://ift.tt/2SpwJRn

https://ift.tt/2z7gkKJ

No comments:

Post a Comment